The EV Mania - Promises, Challenges, and the Road to the Future (Part 1 of 3)

First of a three part series on Electric Vehicles in India

To join the mailing list for Indian Energy Quadfecta, click Subscribe and never miss an issue!

Welcome to the latest edition of Indian Energy Quadfecta where the focus will be on decoding a particularly hot topic: Electric Vehicles (EVs). In this three-part series, we will attempt to separate the hype from reality across various components of the Indian EV ecosystem including manufacturing capacity, charging infrastructure, policy, and consumer adoption.

The Promise

EVs have widely captured public imagination in the energy and transportation space, and now command mass appeal as the ‘cool and climate-friendly’ solution to our sustainability challenges around the globe. India is no exception. In fact, India’s transition to a lower carbon economy is rooted in a heavy bet on electric vehicle adoption. For example, IEA’s Sustainable Development Scenario projects India’s EV penetration will represent 86% of all vehicle sales in 2040 if the country is to achieve the scenario consistent with deep decarbonization.1 This excitement is further amplified by the fact that EVs have the potential to help mitigate four of the most fundamental challenges across India’s energy landscape (a rare ‘win-win-win-win’):

✅ Energy Security: Enhanced self-reliance for transportation sector and reduced dependence on oil from volatile geographic regions

✅ Lower Trade Deficit: Reduced foreign exchange bill from oil imports (currently ~4% of India’s GDP2)

✅ Improved Air Quality: Reduced pollutants from tailpipe emissions, particularly in India’s most polluted cities

✅ Reduced Greenhouse Gas Emissions: Offset carbon emissions from internal combustion engine vehicles

As the country continues to rapidly urbanize and industrialize over the next several decades, it is estimated that nearly 300 million vehicles will be added to the road by 2040.3 What will determine whether this staggering number of new vehicles on the road end up be electric or gasoline-burners?

The Reality

Despite seemingly universal recognition regarding the promise of electric vehicles, today’s reality is that electric vehicle adoption remains low at 0.5% of new car sales in India, even lagging the global rate of ~3%.4 When we further categorize ‘vehicles’, it is clear that the current fleet is almost entirely dominated by two and three wheelers: 98%+ of EVs on the road today in India are two or three wheelers. Among 4-wheeler passenger cars, the EV market in India is really in its infancy, with only 0.12% of the market being electric today.5

So how can we hope to bridge between today’s nascent market penetration figures and the ambitious EV-dominant future that we are hoping to realize? Well, it certainly won’t be easy. Incorporating EVs as a permanent fixture in India’s transportation mix will not be done just by replacing older vehicles with newer ‘greener’ ones, but rather through a complete overhaul of the mobility ecosystem. Robust electric charging infrastructure, enhanced domestic manufacturing capacity, a battery disposal network that essentially has to be built from scratch, coordinated federal and state-level policy support, mass consumer adoption - these are just some of the ‘need to haves’ for a sustainable transition.

To its credit, the Indian government has taken a fairly clear public stand in favor of EV promotion in the country. Direct policy support made headlines in 2015, when the government launched the Faster Adoption and Manufacturing of Hybrid and EV (FAME) scheme to provide subsidies for electric 2 and 3 wheelers as well as cars and public bus fleets. This was followed by the more robust FAME 2 in 2019, which featured 10x the capital outlay, including upfront incentives for EV purchases as well as in support for charging infrastructure deployment.6

“[We] aim to leapfrog and envision India as a global hub of manufacturing of Electric Vehicles”

- Nirmala Sitharaman, Finance Minister, Government of India

“We should move towards alternative fuel[s]... I am going to do this, whether you like it or not. And I am not going to ask you. I will bulldoze it.”

- Nitin Gadkari (in address to key Indian auto makers), Minister of Road Transport and Highways

These policy proposals have often been accompanied by bold statements by government officials, signaling plenty of intent for EV adoption even while implementation has been shaky. One of the more salient examples of this exuberance was India’s announcement to target 100% electric vehicle market penetration by 2030 - a goal so fantastically out of reach that the 100% figure had to be subsequently pared back to 30%! While these policy coordination issues are undoubtedly counterproductive (and occasionally embarrassing), it is not a bad idea to err on the side of dreaming big while tackling problems of this scale - as long as real work is done to ensure it doesn’t simply remain a dream.

Roadmaps and Roadblocks

At a high level, India’s roadmap for mass electrification seems to converge on the following: rapidly expand EV penetration for 2 and 3 wheelers, then passenger cars, and then trucks (in conjunction with hydrogen or alternative fuels over time).

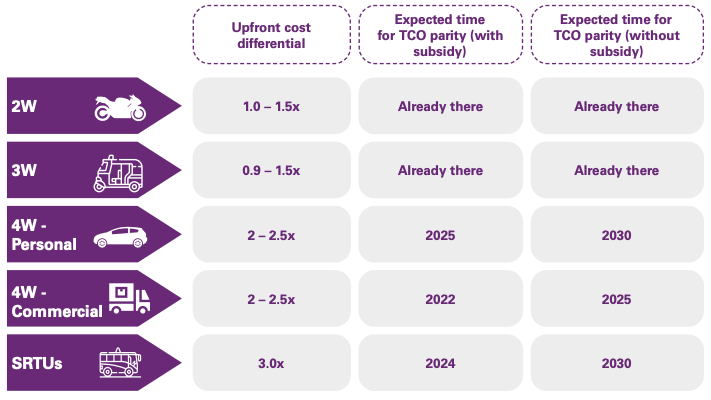

When looking at vehicle ownership costs alone, meaningful progress in the 2 and 3 wheeler market has occurred to date. An analysis by KPMG (shown below) expresses both upfront cost and the total cost of ownership (TCO) for various EVs as compared to conventional internal combustion engine (ICE) vehicles.7

At first glance, the picture on a unit economic basis seems fairly palatable: we are basically already at cost parity for 2 and 3 wheelers and expect to get there in the next 3-5 years for 4 wheelers as well. In reality, however, achieving total cost parity with ICE vehicles solves only a part of the puzzle. Mass adoption of EVs does not occur based on cost parity of individual cars but rather on the presence of a complete ecosystem including battery supply chain, manufacturing capacity, charging infrastructure, and durable unit economics in a range of urban areas.

The next two parts of this series will tackle a number of these key considerations which will likely shape the direction of India’s EV transition…stay tuned!

To join the mailing list for Indian Energy Quadfecta, click Subscribe and never miss an issue!

International Energy Agency, Indian Energy Outlook 2021, World Energy Outlook Special Report

Indian Express, “India's oil import bill falls 10 per cent to USD 101 billion in fiscal year 2020”, May 2020, https://www.newindianexpress.com/business/2020/may/29/indias-oil-import-bill-falls-10-per-cent-to-usd-101-billion-in-fiscal-year-2020-2149579.html

International Energy Agency, Indian Energy Outlook 2021, World Energy Outlook Special Report

International Institute for Sustainable Development, “Is India Ready for an Electric Vehicle Revolution?”, Article originally appeared in IISD's Trade and Sustainability Review, Volume 1, Issue 3.

“The India Electric Vehicle Opportunity: Market Entry Toolkit”, March 2021, Connected Places Catapult, https://cp.catapult.org.uk/wp-content/uploads/2021/03/210318_1020_CPC_India_Report.pdf

IEA.org; https://www.iea.org/policies/7450-faster-adoption-and-manufacturing-of-hybrid-and-ev-fame-ii

KPMG, October 2020, “Shifting gears: the evolving electric vehicle landscape in India,” https://assets.kpmg/content/dam/kpmg/in/pdf/2020/10/electric-vehicle-mobility-ev-adoption.pdf

NOTE: Post Cover Image from KPMG October 2020 Report, “Shifting gears: the evolving electric vehicle landscape in India,” https://assets.kpmg/content/dam/kpmg/in/pdf/2020/10/electric-vehicle-mobility-ev-adoption.pdf

The potential for ev’s growth in India is astronomical; very clearly shown above by Sankalp. I wonder if there is an opportunity to invest? 😃

What a lovely comment: "it is not a bad idea to err on the side of dreaming big..."