To join the mailing list for Indian Energy Quadfecta, click Subscribe and never miss an issue!

Welcome to the second edition of the Indian Energy Quadfecta, where we will focus on arguably the most critical component of the decarbonization story: electricity generation. In any discussion of decarbonization or sustainable energy in the context of India, the country's power generation sector inevitably rises to the forefront - and for good reason too. India's power sector is by far the largest source of its total greenhouse gas (GHG) emissions, at 52%1, and will be center stage in its sustainable energy transformation over the coming decades. In the case of India, decarbonizing the power sector is not just a substitution problem, where renewables replace coal generation one-for-one, but rather a highly complex aggregation and distribution problem where GHG emissions need to be reduced while also substantially expanding aggregate power generation to meet growing demand. The last 20 years have already seen a staggering expansion of the Indian power sector, with more than 900 million (!) electric customers gaining access to a connection for the first time between 2000 and 2019, and electricity demand nearly tripling over that time period.2 The next 20 years is expected to be equally transformational: electricity demand is projected to triple again, and when millions of Indians in the growing middle class turn on their air conditioner for the first time, they will rightfully expect it to work no matter whether its electricity came from coal, solar, or hydropower.

Highly Subsidized, but Still Pricy

In a country where electricity access is still in its growth phase, affordability is undoubtedly a key consideration. But the actual price of electricity in India depends on who you ask - industrial customers, for example, pay wildly different electricity rates than their residential or agricultural counterparts. Like some other developing countries, India aggressively cross-subsidizes electricity prices for residential and agricultural customers by charging higher prices to industrial customers. The result is that India has one of the highest industrial electricity prices in the world on a purchasing-power adjusted basis, which has clear negative implications for the country's manufacturing base and economic competitiveness.

Industrial Electricity Prices (PPP Adjusted) in India and Select Countries

Source: IEA3

Of course, economic competitiveness is not the only relevant consideration here, as there is clearly a social objective motivating electricity cross-subsidization, namely increasing affordability for economically vulnerable residential and agricultural customers. However, it is worth noting that despite these heavy subsidies, residential electricity prices are also higher in India compared to OECD countries on a PPP-adjusted basis. Why these relatively higher prices despite subsidization? Part of the answer lies in the electricity distribution process, where physical and economic losses elevate costs at multiple points in the system.

Losses and Inefficiencies

Credit: © BRADEN GUNEM / ALAMY STOCK PHOTO; as appeared in Nature Energy Article 16044, Energy transmission and distribution: Power theft in India4

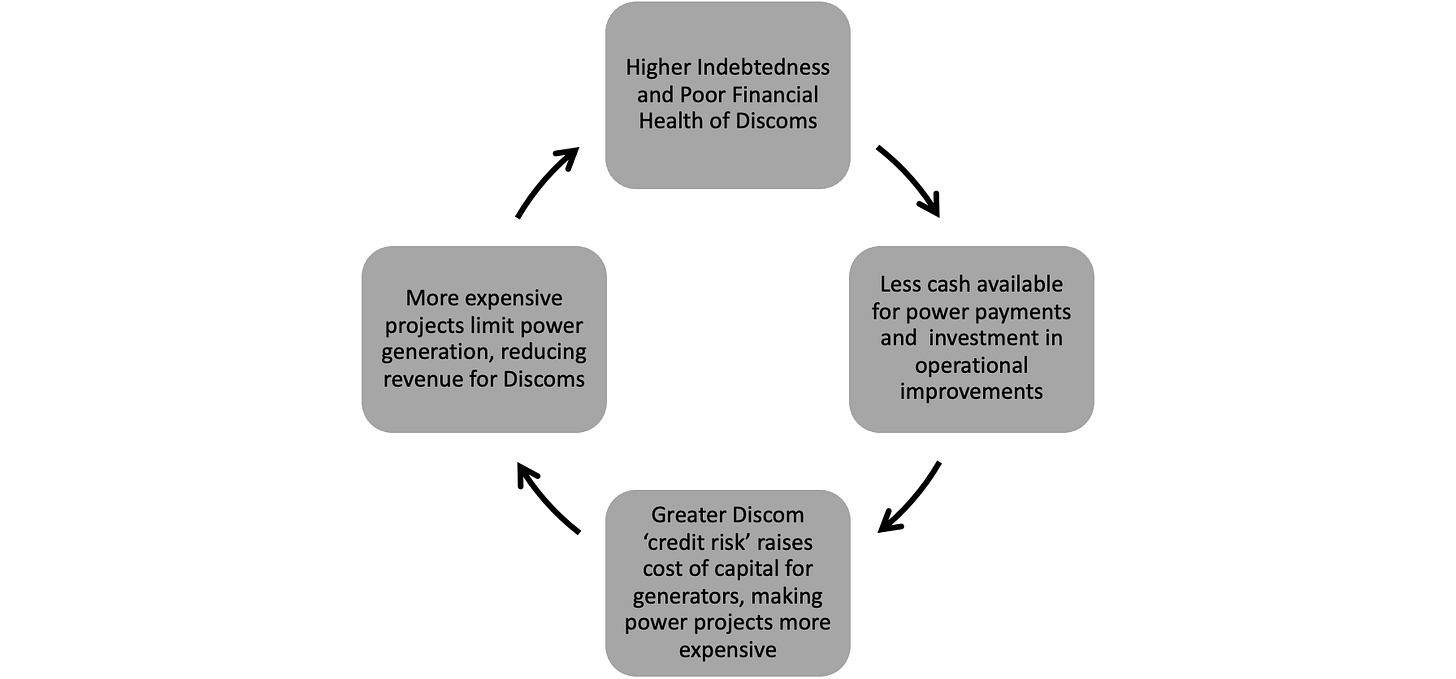

The process for delivering electricity between the generation source and end consumer is highly complex and requires coordination across multiple stakeholders. In India, some of the key figures responsible for this process are state-owned distribution companies (Discoms), which have persistently held a reputation of being both inefficient and insolvent. Discoms have routinely found themselves caught in a vicious cycle of financial distress driven by in part by high levels of Aggregate Technical & Commerical (AT&C) losses, which includes energy losses from the physical power distribution system as well as losses from theft and inefficient collection. For context, India's AT&C losses average around 20%, significantly higher than the global average of 7%.5 Since these Discoms are the most significant customers (also called 'offtakers' in infrastructure-speak) for power generators, the discoms' financial distress is not theirs alone and causes ripple effects throughout the power generation and distribution system. This ultimately also makes its way to the end consumer, who receives a more intermittent, lower quality supply of electricity as a result of the inefficiencies in the system.

Meaningful Progress Has Been Made to Date...

Amidst the doom-and-gloom of power cuts and transmission losses, it is important to take a step back and recognize that there has been some meaningful progress achieved to date. Chief among them was the widely cited household electrification initiative, whereby India was able to achieve near-universal household access to electrical connections for the first time in 2019. Of course, having access to an electrical connection isn't the same as having consistent, 24x7 access to electricity, but nonetheless the former is still an important milestone. India has also made important strides in improving the integration of its power system, most notably creating a synchronous national grid in 2013 which connected the five regional ones, and in turn created one of the largest grids in the world. While much more needs to be done to ensure regular coordination between these regional and national grids, the creation of a unified grid itself is an important step in ensuring power generation resources are optimized. Moreover, meaningful progress has also been made in enhancing the composition of this power system, with explosive growth in solar and wind allowing renewable generation to quadruple between 2000 and 2019, reaching 21% of electricity generation in 2019 (some states even see over 50% renewable generation during some months of the year).

...But Upcoming Challenges Are Great and Will Only Get Harder With More Renewables

Despite the progress made in the recent past, it will be unsurprising to note that considerable work lies ahead for the Indian power sector. In addition to the challenges of meeting rapidly growing demand, there are particular operational challenges that arise from integrating a greater share of renewables. First, one kWh of energy from solar or wind is not entirely equivalent to one kWh of energy from thermal sources like coal since renewables are inherently more variable and intermittent (sunshine and windspeeds are far from consistently distributed). Thus, much like with coal, where negative externalities such as environmental impact are today not priced in to the price of coal generation, the price of renewables may not reflect the externality of intermittency.

Hourly Change in Generation from Renewables in India as a Percentage of Average Annual Demand in the STEPS Scenario (IEA India Energy Outlook 2021)

Projections from IEA's Energy Outlook (shown in the figure above) illustrate that the continued integration of renewables over the next few decades will materially change not just the total amount of load but also the shape of the entire load curve. As renewables are added to the mix between 2020 and 2030, the intra-day and seasonal variation driven by renewables will increase the volatility of hourly generation, and place significant demands on the rest of the grid to balance supply and demand; flexibility will increasingly be the name of the game. Ultimately, delivering electricity in a manner that precisely matches supply to demand in real-time, while also being affordable and clean, will be an essential part of the energy quadfecta.

To join the mailing list for Indian Energy Quadfecta, click Subscribe and never miss an issue!

IEA India Energy Outlook 2021, World Energy Outlook Special Report, International Energy Agency 2021, https://iea.blob.core.windows.net/assets/1de6d91e-e23f-4e02-b1fb-51fdd6283b22/India_Energy_Outlook_2021.pdf

IEA India Energy Outlook 2021, World Energy Outlook Special Report, International Energy Agency 2021, https://iea.blob.core.windows.net/assets/1de6d91e-e23f-4e02-b1fb-51fdd6283b22/India_Energy_Outlook_2021.pdf

IEA, Industrial electricity prices in India and selected countries, 2005–2019, IEA, Paris https://www.iea.org/data-and-statistics/charts/industrial-electricity-prices-in-india-and-selected-countries-2005-2019

Rubino, A. Energy transmission and distribution: Power theft in India. Nat Energy1, 16044 (2016). https://doi.org/10.1038/nenergy.2016.44

IEA India Energy Outlook 2021, World Energy Outlook Special Report, International Energy Agency 2021, https://iea.blob.core.windows.net/assets/1de6d91e-e23f-4e02-b1fb-51fdd6283b22/India_Energy_Outlook_2021.pdf

Source for Email Cover Photo of Issue 2: https://energy.economictimes.indiatimes.com/news/power/coronavirus-impact-within-ten-days-26-per-cent-fall-in-indias-energy-consumption/74854825

As we move toward multiple sources of electricity and less reliable grid, we will see distributed micro grids such as simulated at the Idaho National Lab see https://factsheets.inl.gov/FactSheets/Microgrids%20Backup2021.pdf.